carbon credit exchange expire

Whether they’re trading EU allowance futures or carbon credit futures, investors are in it for the same reason: they want to profit from the rising price of carbon emissions. And while this market is largely free of regulatory hurdles, there are still challenges to building liquid markets and scaling supply.

The world is facing humanity’s greatest crisis ever: climate change. The atmospheric concentration of CO2 has jumped 48% since the pre-industrial era, and we’re already seeing the effects in everything from global warming to ocean acidification and declining air quality.

To reduce these risks, governments and other institutions put caps on how much industrial companies can emit in a given period of time. Those that exceed their limit must buy carbon credit exchange to offset their excess emissions. The first of these was the European Union Emissions Trading Scheme (ETS). Since then, a variety of schemes have sprouted around the globe to control and regulate carbon emissions.

will carbon credit exchange expire

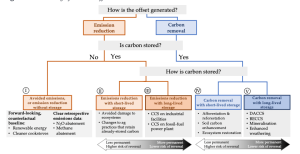

These compliance reductions are known as the “compliance market.” In this world, carbon credits can be created through agriculture or forestry practices, directly capturing greenhouse gases from the atmosphere, or by working with middlemen to offset an organization’s emissions. This is how farmers and other landowners earn money when they plant trees; corporations pay to offset their own emissions, and middlemen make a profit along the way.

The other market for carbon credits is the voluntary reductions world. This world is driven by corporate social responsibility, ethics and a desire to enhance reputation. It also includes entities that purchase carbon offsets before they’re required to do so by regulation.

In this market, carbon credits are called Certified Emission Reductions (CERs). Each CER represents one metric ton of reduced, avoided or removed GHGs. The credits can be sold in a variety of ways, including through an exchange-traded fund (ETF).

One of the biggest problems with these voluntary reductions is that double counting can occur. The same credits can be used over and over again — even within the same project, where it’s often done to save time and money.

This double counting is a real problem in the carbon market, and it’s not just a matter of a few people misbehaving. When these credits are resold in the compliance market, they need to undergo “corresponding adjustments” to ensure that they’re not counted twice. It’s a process that can take years and requires the cooperation of every party.

If these requirements aren’t met, it will be difficult for the voluntary market to scale up and serve as a valuable tool for businesses looking to reduce their emissions. To avoid this, a standard set of rules must be established to control the quality of carbon credits and make them available for sale in regulated markets. To do this, carbon credit exchanges must create “reference contracts,” based on core carbon principles and a standard attribute taxonomy that can be applied to different kinds of projects. This approach would build a foundation for liquid, scalable carbon markets.