Bank’s Accounting Records

In general ledger accounting, a general ledger, called a simple general ledger, is an overview of a company’s transactions, showing year-end balances and collections. General Ledger accounting is used to track and organize financial data that has been recorded by journals and ledgers. Generally, a general ledger is a version of the double-entry bookkeeping system that has been adopted since the medieval ages. It is the predecessor of the modern computerized general ledger.

The double-entry system is the method for recording the financial transactions in the traditional way. Every financial transaction is recorded either in the debit or the credit column according to the rule followed in the manual accounting system. General Ledger is used to record the daily sale and purchase activities as well as to facilitate the preparation of the annual and quarterly reports. This also enables the general ledger to provide information on the inter-relationship among the different enterprises of the firm.

For a general ledger to work effectively, it must be computerized. The data entered is stored in the computer systems as records in the form of statements. The statements, which are known as the accounting data, are then processed either by the machine or by the humans who enter the data in the given accounts. In most cases, the entry is made twice, once for the debits and once for the credits.

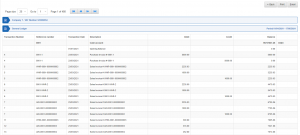

Role Of General Ledger In The Preparation Of The Bank’s Accounting Records

Generally, the data is entered by adding the values of the debits and credits against the income statement of the firm and then comparing the results. If the result is a positive one, then it indicates that the transaction is being performed and the owner of the account gets his/her income. On the other hand, if the result is negative, then it indicates that something is wrong with the financial data, which should then be corrected.

Some general ledger accounts contain information on the stock transactions. For example, the inventory, the sales, the purchase and the net sales are all recorded under the general ledger entries. The data on these stock transactions is used to determine the balance sheet and to make an assessment of the profit and loss account. The information on the stock entries is also used to give the net income statement.

The general ledger accounts also contain information on the loans and advances to and from the enterprise. Most banks use the general ledgers to make their financial statements. This is because general ledgers enable them to easily calculate the interest payable on their loans and advances. Therefore, the general ledger plays a vital role in the calculation of the cash account of the bank.