QuickBooks for the Self Employed

QuickBooks Self-employed is designed primarily for contractors and freelancers, specifically people who do not have either separate personal account and business accounts. If you utilize a separate or shared accounting software, you will not get much value out of this service. But when you are blending business and personal life, you will appreciate intuitive applications to assist you manage, sort and classify incoming transactions. For instance, if your business involves some inventory or contract purchasing and sales, then you will need a program that can calculate tax and other charges properly. Or if you have employees, you will need a program that is capable of tracking time, attendance and leave details.

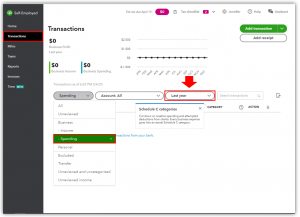

With the QuickBooks Self-employed package, there are also several other useful features such as employee cash advance tracking, payroll processing, tracking of time and labor, tracking of taxes, as well as various other advanced reporting functions for quick analysis of large amounts of data. There are also several tools designed specifically for contractors and small businesses. For instance, you can prepare checks and invoices, print receipts, make custom reports, and perform basic bank functions such as bill consolidation, payroll management and paper savings. If you are a small business owner, then you will find these additional features especially useful, and especially if your business transactions are very complicated.

Some small businesses and freelancers do not want to deal with accounting software and this is where QuickBooks Self-employed can prove to be useful. The program enables you to make, classify and handle accounting transactions with ease and confidence. When you are self-employed, you don t want to spend your time tracking your business transactions manually, so you can delegate this task to an accountant or a QuickBooks Pro. However, you may want to get some help with your accounting work. You can pay for a QuickBooks consultant to assist you every month and perform all of your accounting tasks for you. Even if you are just freelancing, you want to have someone reliable doing your accounting work so you can trust that the information that is entered into the system is accurate.

How to Utilize QuickBooks for the Self Employed

For most small businesses, the best choice would be to use QuickBooks as a part of your business transactions instead of using QuickBooks Professional. Using QuickBooks as a part of your accounting system may increase profits because you may be able to track all of your business transactions in a more user-friendly manner. With the QuickBooks Self-employed package, you can create invoices and other billing documents quickly and easily, and you can enter information about your invoices in a user-friendly manner. In addition, you can create your own work flow with QuickBooks, and you can create custom reports in a quick and easy manner. This means that with the QuickBooks self-employed option, you may want to upgrade your software such that you can learn how to customize it to meet your unique business needs.

If you are a business owner that uses a vehicle for most of your business trips, you may want to consider the use of QuickBooks Professional with mobile devices. This accounting software offers you the ability to input your billing information through your laptop, and it will automatically calculate the tax deductions you are entitled to take for the expenses that you incurred during your travels. If you are traveling on a frequent basis, you can also use the QuickBooks self-employed tracking mileage feature. This will enable you to see where you are spending your time and money, which can allow you to make necessary changes before you incur any further expenses that you cannot afford. It also allows you to make sure that you do not incur any additional charges for using your vehicle.

With the QuickBooks self-employed package, you will be able to enter your bills and billing information through your laptop, which eliminates the need for you to bring your computer along when you invoice your clients. This will enable you to keep expenses separate from your invoicing, which will eliminate confusion in both your financial records, as well as your accounting records. The QuickBooks Pro version includes an entire suite of small but useful features that will help you run your accounting processes more efficiently. You can download the software quickly and begin amassing your tax deductions today.